Roth ira calculator 2021

The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each year.

Earlyretirement Retirement Calculator Early Retirement Retirement

The amount you will contribute to your Roth IRA each year.

. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. The Standard Poors 500 SP. Roth Ira Contribution Limit 2021 Calculator.

This calculator assumes that you make your contribution at the beginning of each year. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. For instance if you expect your income level to be lower in a particular year but increase again in later years.

You can use this calculator to help you see where you stand in relation to your retirement goal and map out. For 2022 the maximum annual IRA. This limit applies across all IRA accounts.

For 2022 the maximum annual IRA. See the impact of employer contributions different rates of return and retirement age. This calculator assumes that you make your contribution at the beginning of each year.

Converting to a Roth IRA may ultimately help you save money on income taxes. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Roth Conversion Calculator Methodology General Context.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. It is important to.

The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. 9 rows Amount of Roth IRA Contributions That You Can Make For 2021 This table shows whether your contribution to a Roth IRA is affected by the amount of your.

The amount you will contribute to your Roth IRA each year. Project how much your Roth IRA will provide you in retirement. This calculator assumes that you make your contribution at the beginning of each year.

Your retirement is on the horizon but how far away. This calculator assumes that your return is compounded annually. The actual rate of return is largely dependent on the types of investments you select.

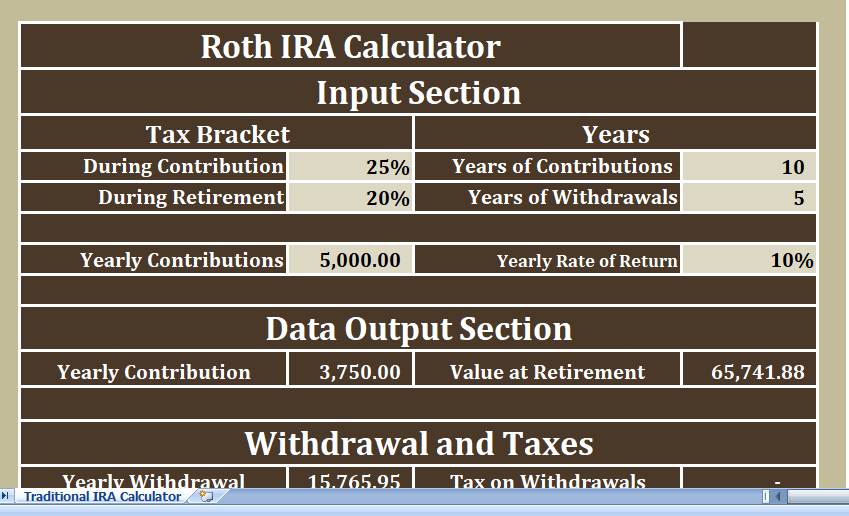

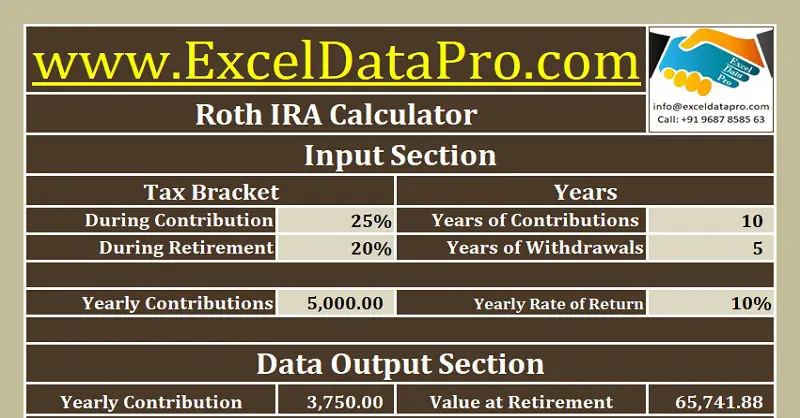

Roth Ira Calculator Excel Template For Free

Download Roth Ira Calculator Excel Template Exceldatapro

Contributing To Your Ira Start Early Know Your Limits Fidelity

How To Max Out Your Roth Ira In 2021 Imperfect Finance

Historical Roth Ira Contribution Limits Since The Beginning

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Roth Ira Calculator 2022 Thrivent

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Roth Ira Calculator Advantage One Credit Union Mi

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Roth Ira Calculator How Much Could My Roth Ira Be Worth

2021 Business And Life Review Happier Freelancing In 2022 Life Review Budgeting Blogs Life

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management