Fica and social security tax calculator

This taxable portion goes up as your income rises but it will never exceed 85. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Tax Calculator Estimate Your Income Tax For 2022 Free

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

. The fica tax calculator exactly as you see it above is 100 free for you to use. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. Tax rates are set.

Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. Ad Access Insights On Retirement Concerns The Impact Of Taxes. This means that youll pay the Social Security tax on 62 on your earnings up to 147000.

FICA Tax Limits The Social Security wage base is set at 147000 in 2022. The Social Security portion of. Social Security benefits are 100 tax-free when your income is low.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. The standard Medicare total deduction is 29. Social Securitys Old-Age Survivors and Disability Insurance OASDI program and Medicares Hospital Insurance HI program are financed primarily by employment taxes.

Free Social Security calculator to find the best age to start SS benefits or to compare the differences between starting SS at different ages in the US. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Stock Market Investing Online Calculators Valuation.

Social Security and Medicare Withholding Rates. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For example if an employees taxable wages are 600 this week.

The rate consists of two parts. Here is a breakdown of these taxes. 60000 x 62 3720 this amount would.

Calculation of FICA Tax Multiply an employees gross salary by the Social Security and Medicare tax rates to compute their FICA tax payment. For example if an employees. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for.

The current rate for. The total FICA tax is 153 based on an employees gross pay. The employee pays 145 as does the.

The self-employment tax rate is 153. FICA hence why they. Ad Find Out How Much You Can Save with Our Free Fica Tax Calculator.

The Old-Age Survivors and Disability Insurance program OASDI taxmore commonly called the Social Security tax is calculated by taking a set percentage of your. Since the rates are the same for employers and. Lets say your wages for 2022 are 135000.

Even if your annual income is 1 million. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Ad Calculate The Best Age to Claim and How to Maximize Your Social Security Benefits.

We Provide a Full Range of Services to Help You Achieve Your Goals. Social Security is calculated by multiplying an employees taxable wages by 62. Like social security there is both an employer and employee portion that is paid.

You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates. If your income is above that but is below 34000 up to half of. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. The employer and employee each pay 765. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Easiest 2021 Fica Tax Calculator

Easiest 2021 Fica Tax Calculator

Paycheck Calculator Take Home Pay Calculator

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

What Is Fica Tax Contribution Rates Examples

Social Security Tax Calculation Payroll Tax Withholdings Youtube

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

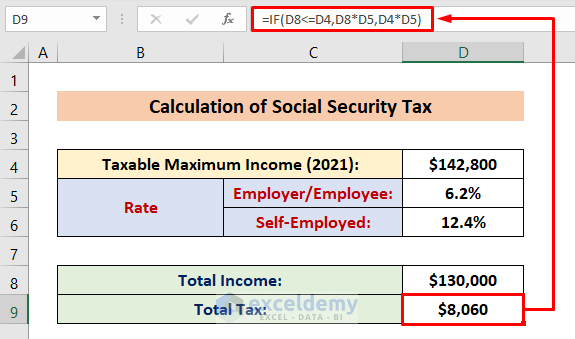

How To Calculate Social Security Tax In Excel Exceldemy

Paycheck Calculator Take Home Pay Calculator

Social Security Benefits Tax Calculator

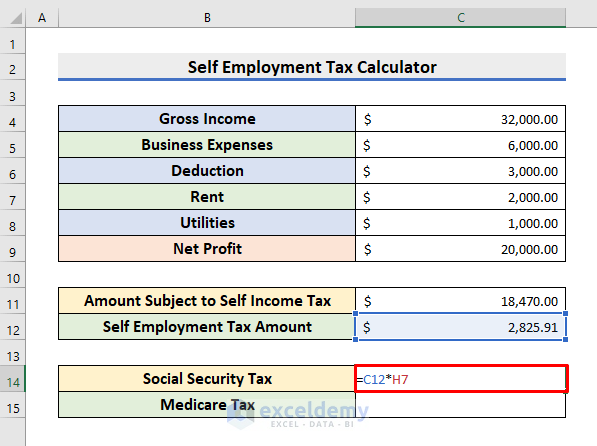

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Tax Withholding For Pensions And Social Security Sensible Money

Social Security Benefits Tax Calculator

Payroll Tax Calculator For Employers Gusto

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube